Crypto is envisioned as a decentralized currency. While this looks exciting on paper, the real-life application has its own bottlenecks. In addition to the volatility and widespread acceptance, there should be someone to validate the authenticity of transactions. We have a definite appearance and feel for fiat currencies to avoid counterfeiting. But crypto has no such thing. These are computer currencies that a skilled programmer can develop with some lines of code. That can lead to a world with the coding guys having an unfair advantage over ordinary people. And that’s where we need crypto mining. To keep it fair. Put simply, mining validates your transactions and controls whatever goes up on the blockchain. And because it’s profitable, there are huge mining farms running tailored equipment earning substantial money from it. In the same fashion, some people do it wrong and end up with their aged miner equipment and a not-so-pocket-friendly electricity bill. So it’s extremely vital to know it inside out, especially if you’re trying to mine something like Bitcoin, a coin with significant mining difficulty.

Factors Affecting Mining Profitability

Most importantly, everything depends on the coin. Hardware, software, and all the calculations are done specifically for a single coin. So, we’ll go along with the mighty Bitcoin and the Litecoin (which is easy to mine) and see how the factors affect the mining profitability of these two.

#1. Hashrate

It’s the processing power of your miner, measured in H/S, i.e., hashes per second. Higher hash rates are represented in kilo hashes per second (kH/S), Mega hashes per second (MH/S), etc.

#2. Power Consumption

Measured in watts(W), it’s the energy spent by the miner per second. This is generally listed on the manufacturer’s website. And remember to consider all the equipment if you’re using a setup of multiple miners.

#3. Electricity Cost

This will be based on your location and relates to the power consumption. You can check out the electricity prices of most countries with this tool. The low industrial electricity cost (along with favorable climate) is the reason Genesis Mining is set up in Iceland.

#4. Crypto Value

Another important factor affecting mining sustainability is the crypto itself. As mining gives you more of the coin you mine, its value holds utmost importance to you. For instance, you get 6.25 BTC for mining each block, which amounts to nothing if Bitcoin’s value somehow plummets to the ground.

#5. Mining Set Up

Back in 2009, when Bitcoin was inducted, you could have mined with your personal computer without anyone sniffing about it. At present, depending upon the coin, you could need specialized hardware and significant real estate to get started. But that’s not enough, the excessive heat will degrade your miners way too fast, and the constant humming of the machines will be a nightmare for the workers and the neighbors alike. So you’ll also need to invest in cooling equipment, plan for the noise canceling, and still be ready to deal with problems specific to your setup.

#6. Network Difficulty

Network difficulty is an indicator of how difficult it is to mine a block. Alternatively, it also reflects the strength of a network and the resources needed to compromise it by something like a 51% attack. The Bitcoin mining difficulty at the time of its inception was 1. Today it is 29,794,407,589,312~29.794 trillion. It changes as per the number of participating miners. For instance, the Bitcoin network creates a block every 10 minutes. So the network will raise the difficulty level if more miners join. In contrast, it will ease off if miners leave the network to keep a constant flow of block generation per unit time. Conclusively, you need to remain prepared for the fluctuations and have some extra power at your disposal. Otherwise, you can be at a loss if the network difficulty rises in the future, with the last resort to add efficient hardware or switch to a separate coin for mining profitably again.

#7. Block Reward

50 BTC was the Bitcoin network’s block reward in 2009. Now it’s 6.25 BTC. By 2024, it’s going to be 3.125 BTC, and so on. These are called halving events which reduce the coins going into circulation. For Bitcoin, the block reward is halved after every 210,000 blocks to induce synthetic deflation, an attempt to appreciate Bitcoin’s value. You must factor in halving as the cost to sustain mining goes up naturally, while the rewards surely go the other way. It may make mining unprofitable unless the coin appreciates countering the periodic cut in block reward. In addition, every halving event risks the miner’s exodus or death spiral. This starts with miners abandoning the network due to the reduced block reward, pushing the coin’s value down. Subsequently, others follow suit, leading that crypto to a death spiral. Although this has little effect on the mining profitability at first, this might be a factor to consider in the future.

#8. Pool Fee

A pool is a group of miners trying to mine blocks by joining their forces. The major software setup is taken care of by the pool admin, and the members pay a small pool fee for enjoying this simplicity. This is generally about 1-3% of your individual reward. Not a big factor, though, as joining a good pool also means greater chances of winning a block. So that covers most factors that could make or break your mining income. Now, let’s take some examples and predict the mining income with crypto mining calculators.

Crypto Mining Calculators

Please note these calculations give only an approximate idea. Your real mining income can be quite different from those calculated by any of these calculators. For this, we’ll assume your miner has a hash rate of 100 TH/S or 100 * 1012 H/S and a power consumption of 3000W. In addition, we’ll take Canada as the mining destination because of the lesser temperatures. As per these global electricity prices, Canada collects the equivalent of USD 0.1/kWh from business owners. Conclusively, we’ll go forward with the following variables:

#1. CryptoCompare

CryptoCompare is the best and the easiest one to predict the mining income of a few notable cryptocurrencies. For the tabled values, it predicts a meager USD 3800 per year if you choose to mine Bitcoin. But what if you mine Litecoin with the same constraints: Then why do people mine Bitcoin and not Litecoin? I have searched a lot and came to only one point-Bitcoin Maximalism. These Bitcoin folks (some of them) believe that BTC is the ultimate digital asset and that sooner or later, all cryptocurrencies will fade out, leaving the original, undisputed king at last–Bitcoin. Personally, I would mine Litecoin, especially if I’m on a tight budget.

#2. CoinSmart

CoinSmart’s crypto mining calculator is more detailed in that you can enter custom network difficulty, exchange rates, hardware cost, etc. Please note that this shows results in CAD, the Canadian dollar. With this calculator, the Bitcoin mining profit turned out to be 4,188.49 CAD (3,285.91 USD). Similarly, LTC mining yearly outputs with similar variables would be CAD 68.47 million (~53.46 million USD). However, using the CoinSmart mining calculator for Litecoin might not be accurate because it’s listed for only Bitcoin mining. So it might be calculating based on Bitcoin network parameters, which differ from Litecoin’s. For instance, with Bitcoin, a block is mined every 10 minutes. In contrast, it takes just 2.5 minutes to mine a Litecoin block.

#3. CryptoRival

Chances are you’ll find a dedicated mining calculator at CryptoRival, as they have a calculator for over 100 cryptocurrencies. This one reported an annual profit of USD 3,309 for BTC and USD 53.46 million for LTC mining.

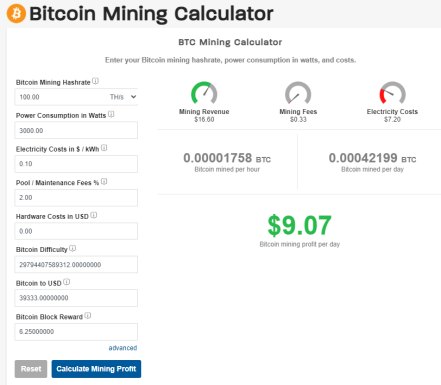

#4. CoinWarz

CoinWarz has a similar mining calculator that lets you customize the values as you see fit. With our agreed-upon variables, this predicted a USD 9.07 per day (or USD 3310 a year) for BTC mining. The same outcome for Litecoin mining was a lucrative USD 54.02 million a year.

Conclusion

So this was a very brief article about crypto mining profitability and the factors affecting it. Still, we must warn you about the risky adventure you’re up against. Finally, no article can summarize your potential mining profits (or losses). It’s highly unpredictable and depends on the particular mining conditions. Chances are less that a crypto beginner might be reading this, but if you are, check out this crypto lingo for a better understanding of this fascinating world of computer coins.