Tax software is one way to make your life easier while saving money! You can save time, maintain accurate records, reduce errors, and do your taxes in less time with tax software. These things are crucial for small business owners who want to focus on their company’s success rather than bookkeeping. This article will explore some of the best tax-planning software for small to medium-size businesses. You’ll learn what each one offers, how it works, and what to consider when looking for your perfect tax-planning software. If you’re searching for a new tax-planning software company for your small to medium business, this article will help you find one that will work well for your needs and budget.

What is tax planning?

Tax planning is an ongoing process of forming strategies for your business—especially its tax-related aspects. It can include creating a budget, setting up a business structure, and determining how best to capture revenue. Many SMBs and SMEs are faced with the challenge of how to pay taxes on their profits. That’s where tax software comes in handy. With technology constantly evolving, it’s now easier than ever to file your taxes using the software. Tax software allows you to take care of all the necessary filings so that you don’t have to worry about them anymore! Tax software helps reduce your mental load by automating a lot of the work for you. You can also use these programs to find out what deductions are available for your business and see where you comply with government regulations and rules.

Why do you need tax planning software?

Tax planning software is essential for every small business owner’s arsenal. It allows you to prepare your taxes quickly and efficiently, making getting the tax refunds you deserve easier. As an SMB owner, you know how crucial accurate record-keeping is for your company’s success. Tax planning software helps you keep track of all your expenses, which is essential for reporting taxes accurately. It lets you plan out how much tax is due, what deduction can be claimed, and more. It’s just one of the best ways to save money while preparing your taxes as soon as possible! You’ll also have access to all the tools available from this software that will help you save time and money on your taxes.

Benefits of using a Tax Software

Tax software can help you save time, reduce errors, and maintain accurate records. It also allows you to manage your finances with ease! Tax planning: Planning out how much you’ll be paying in taxes for the next year can be challenging if you’re not a tax professional. You can do some research, or else you’re going to spend a lot of time filling out paperwork. With effective tax planning software, you won’t have to worry about this anymore, as these programs can help find the ideal way to file your taxes. What’s more, many of these programs will calculate how much money you should save by using them effectively! Streamlined bookkeeping: Bookkeeping is one of those tasks that often gets overlooked because it seems complicated. But with tax software, this task becomes easier since all your necessary financial data is stored in one place. This makes it easy for anyone who handles this task to make changes quickly without searching through different papers scattered across the office. Accuracy: Using tax software saves time and costs less in errors than doing it. Regardless of your business size, tax planning software will suit your needs. Here are nine different tax planning software programs that you can use today.

ProSeries Tax

With ProSeries Tax, you can build a connected virtual tax office equipped with powerful tax software and integrated solutions for taxpayers, which help you concentrate on delivering the highest financial results to your customers. Formulas for tax-related data entry- Select from over 3,700 forms and utilize ProSeries forms-based input for data which provides you with a simple display that is simple to explain to customers. Advanced diagnostics: Reduce rejections and increase your clients’ refunds with more than 1,000 diagnostics that will assist you in reviewing and optimizing every tax return. You’ll be able to rest easy being confident that ProSeries tax software will automatically detect mistakes and errors in data. Access online: You can access it online on desktops anywhere, anytime. It is a cloud-based application that gives you benefits such as fast updates, automated backups, integrated layers of safety, multiple-user accessibility, and much more. Financial Institution download: Download the 1099 and W-2 forms directly from your favorite financial institution. You can access more than the 275 supported partners for free through the ProSeries software.

Bonsai

Bonsai is aimed towards self-workers to help them save maximum on taxes. This tax tool conveniently imports your purchases via the linked cards and groups them in appropriate classes. The best thing about Bonsai Tax is auto-identification of write-offs which you otherwise can miss overpaying taxes. Besides, you get quarterly tax estimates to get an idea of the total tax liabilities. Not only tax, but you also get a great invoicing tool and vetted contracts for business use. Bonsai Tax is an international tax calculation utility supporting 180 currencies globally. Interestingly, you can pause your subscription for up to three months and restart it when things get going. Moreover, you can cancel the subscription anytime and continue accessing your documents and free Bonsai features forever. Finally, there is a two-week free trial to give it a go and see if it works for you.

Drake Tax

Drake Tax is packed with features that will help you swiftly and efficiently process and prepare your clients’ tax returns. It means you’ll be able to stay focused on the most important things – working with customers and growing your business. The speed you require: Drake Tax helps you do everything faster and speed up the process of preparing your tax return. Calculation results and complete return information is just a few clicks away. Drake Tax Planner: Let clients know how the status of their marital relationship, dependents, income, and more can impact their tax returns. You can save multiple scenarios and modify options for reporting as needed. Calculation results concisely show return information, including errors and notes, fees, refund amount, and e-file file eligibility. Screens for PINs and Consent are provided to customers who want to sign off on the return, the consent form, and other bank papers. Drake E-Sign: Make use of an additional signature pad to securely combine customers’ signatures to the returns. This eliminates the requirement for a paper copy. Automated data flow from federal returns to city and state returns, with overriding options. State and city returns are produced as required. Drake Tax fills in automatically from ZIP Code and EIN entries. Other authorities’ credit taxes are paid automatically.

Holistiplan

Holistiplan expands the tax planning process to make tax consulting more thorough and efficient. With the help of advanced OCR technologies, Holistiplan can read a tax return and produce an individual, white-labeled tax return that includes pertinent observations in just a matter of minutes. Generate Client Deliverable: Holistiplan gives a neat and easy-to-read client document that includes your company’s logo at the top and your company’s disclaimer at the end. It can be saved to pdf and then emailed or printed to be reviewed and discussed with clients in person. Instant Scenario Analysis: The same OCR technology can also fill in an analysis screen that allows advisors to instantly identify the most crucial income breakpoints that can be used for tax planning possibilities.

Tax Planner Pro

Tax Planner Pro has an easy-to-use interface, simple-to-follow instructions, and experts guide you through each tax-saving strategy. It’s among the top apps designed for small-sized businesses. Small Business Tax Planning: After you’ve connected your financial information with Tax Planner Pro, their tax strategy engine known as IVAN will evaluate your financial situation and create a custom tax strategy for your company and you. They will show you how to cut down the tax burden to $1.00. It might take five plans, or it might require 30 or more, but we’ll reduce your tax bill! Multiple-Business Projections & Planning: If you own several businesses, use the “Hydra” feature that allows you to sync up to eight QuickBooks Online or Xero businesses to one taxpayer. With Hydra, you can mix and match different business bookshelf platforms, business types, and many more. The projections and return figures show the aggregate performance of all businesses. Sync Your Bookkeeping: Stay up to date by automatically synchronizing your finance sheets and other integrations. The setup process is easy and takes just less than a minute. Proactive Updates & Advice: You can update your tax projections and options every week to ensure you are constantly updated with the latest information. The QuickBooks Online sync will notify you when new information is available and provides alternatives to plan your work. Upload Your Tax Returns: Tax Planner Pro can read your tax returns and do complete data entry on your behalf to automate tax planning completely.

TaxPlanIQ

TaxPlanIQ is an application for managing projects designed for tax professionals. It is an easy-to-use tax planning system created to enhance your business and allow you to take back control of your company. Your clients require more than just a numbers cruncher. They need a financial partner that they can count on. TaxPlanIQ simplifies your life and demonstrates the immense value you can provide. Get started with your trial. You have 14 days to get familiar with and observe the results from TaxPlanIQ. You will see an immediate increase in the value of your investment. They will go through your initial tax-related plan with you to get familiar with the return on investment. Watch TaxPlanIQ transform your accounting company. This platform is created to increase your business’s value and give you back control over your company.

Reduce the chance of mistakes and increase your confidence in the work you produce for your clients.Reduce the complexity of your business as you’re supported by the best practices that result in an incredible ROI that boosts your business.Don’t be afraid to take on the tax burden knowing that you have a support system and team of tax professionals on your side.Discover unique insights in real-time because TaxPlanIQ provides the information you require quickly and precisely.Make better choices for your customers that can save them time or money. They can also let you charge on the value.

Save time by using tax strategies that simplify work, have been approved by attorneys, and help improve lifestyle balance.

Thomson Reuters

Automate the entire process of managing taxes for your business using the efficient, time-saving tools in Thomson Reuters UltraTax Professional Tax Software. You’ll have access to an entire range of state, federal, and local tax-related programs, including 1040 personal, 1120 corporate 1065 partnership 1041 trusts and estates, and multi-state returns. UltraTax CS seamlessly integrates with other Thomson Reuters solutions, including CS Professional Suite and Onvio cloud software, which means no need to devote any hours of manual processes. You can meet all your tax workflow requirements by implementing end-to-end, customized software built upon cloud computing and advanced data sharing along with paper-free processing. Multiple monitor flexibility: You can simultaneously view input, forms, previous year’s input, diagnostics, and more on up to four separate monitors. Instant prep checklist: Start every year with a list that instantly brings up the fields containing your client’s information from the previous year’s tax return. Easy data sharing: Automatically link returns with Tax ID numbers, so you don’t have to manually connect the 1120S, 1065, or 1041 tax returns with the 1040 tax return. Advanced capabilities for e-files make use of e-file software to track each phase of the filing process to ensure that the returns are accurate and complete. Multi-state processing: Use the Apportionment grid to calculate business returns and the Multi-State Allocation grid to calculate the Schedule C and K-1 tax spread across states. UltraTax CS-Electronic Signature: This feature lets you effortlessly collect electronic signatures for tax documents from any location.

TaxWise

TaxWise provides tax professionals with the most advanced tax software that can help increase productivity, revenue, and efficiency so that you can concentrate on the clients you serve and expand your business. Suppose you are preparing your own 1040 tax returns or corporate tax returns, or are a new Tax Payer, an experienced Tax Payer, or are a Service Bureau. In that case, TaxWise provides the resources and tools to assist you in preparing and filing additional U.S. tax returns in less time – anytime, anywhere with the help of our Virtual Tax Office. TaxWise provides various payment options for fees that range from traditional refund transfer services (bank products) and low-cost alternatives that allow you to collect fees without cost to your taxpayer. Make your business more efficient by utilizing TaxWise now! TaxWise Online: Powers the Virtual Tax Office. It is upgraded with their Vault Document Storage, eSignature, Client Portal and TaxWise Mobile to help support your capability to run a cloud-based tax preparation company safely. It enables you to access your tax returns and office documents from any location, anytime. TaxWise Mobile: It offers your customers an easy and secure method to begin their tax return from the convenience of their phone, computer, or tablet. TaxWise Mobile is used by the taxpayer to upload tax documents and fill in the basic information for their return incorporated directly into tax returns in TaxWise Online, saving you time. TaxWise Desktop: Installed locally on your office computer and network The vital TaxWise Desktop software stores your tax return’s information on your computer and gives you access to individual 1040, 1065, 1120,1120S 10, 41 706, 706, 709, and the 990 tax returns for the business. Time-Saving Features: Make more tax returns using these time-saving software tools. Live monitor of refund easy coloring, analysis via hyperlinks that verify any errors in e-filing before you file Line by line tax help, as well as tax form defaults that let you reduce tax preparation time by 20 percent! Refund Transfers: TaxWise offers a broad range of payment methods that permit your customers to deduct taxes preparation costs from their tax refunds; that range from traditional refund transfer services (bank products) and low-cost alternatives that are free for your taxpayer. Bilingual Spanish Features: Use more than 60 tax forms and schedules available in Spanish. The support for bilingual products ensures that your staff always receives the assistance it requires.

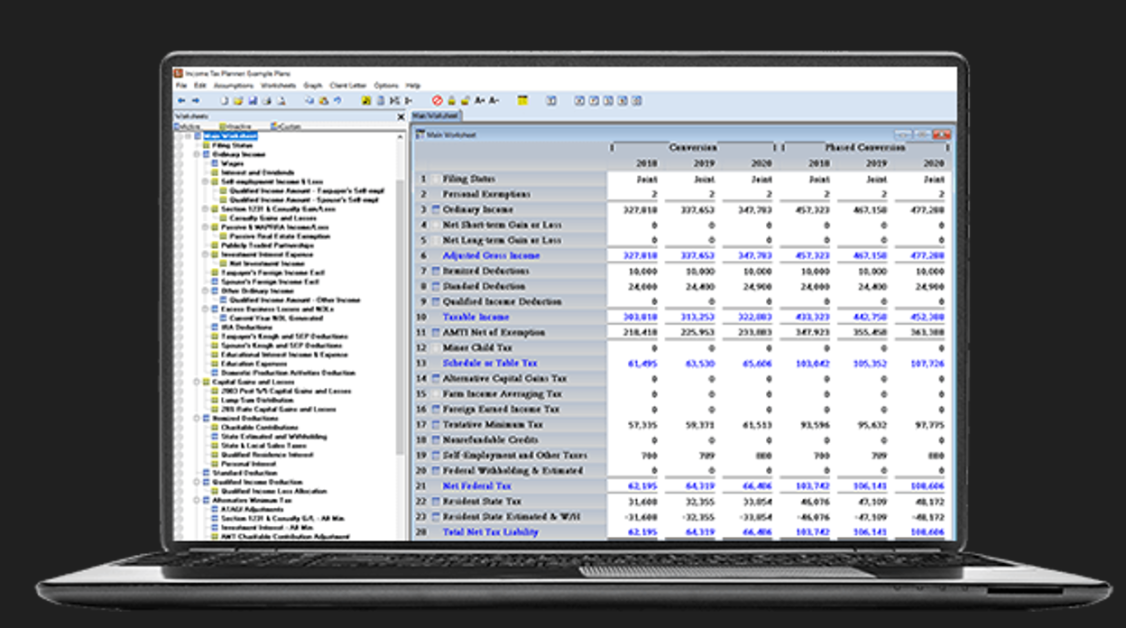

Income Tax Planner

Income tax planner by Bloomberg allows you to quickly deal with complex tax planning issues to reduce tax liabilities and offer the most efficient strategies to your clients while adhering to the most recent tax laws of both states and federal. Maximize the return: Estimate accurately estimated tax-free capital gains, capital gains, and taxes for resident and non-resident states. Plan for tax implications throughout the year-long, resulting from marriages, Roth conversions, stock sales, and other things with the Income Tax Planning. Expertise that you can trust: Provide clients with accurate and efficient information about how their tax situation appears through a thorough study and comparison of two scenarios. Make precise, professional, and efficient plans that assist your clients in reducing their tax burdens and making informed choices. Make it easy to understand and navigate complex tax-related scenarios. Make use of Bloomberg Tax & Accounting’s expertise in taxation with up-to-date calculations, detailed analyses, projections, and much more to determine the most efficient option for your clients in tax, investment, or retirement plan. Plan fast: Increase your productivity by using the correct income tax planning strategy. Income Tax Planner handles the heavy lifting with time-saving wizards and software and automatic calculations and analysis. Specify the variables that you’d like to model – capital gains, estate tax and farm income retirement, phaseouts, and more. You’ll receive instant results as well as insight into which option is the most tax-efficient on behalf of your clients. Results: Make plans together with your clients. If you’re a CPA or financial planner, or wealth management expert, making income tax calculations and presenting your clients with the effects of various scenarios is easy using the ability to compare two views and give an insightful presentation. Training and Support: Unlimited technical support can help you succeed and make the most of this tax-saving tool. The team comprises experts on-site Bloomberg Tax & Accounting employees (many lawyers and CPAs). You receive expert knowledge of the program and an understanding of the real-world accounting and tax issues you’re confronted with.

Corvee

Corvee is a cloud-based tax planning software, client collaboration, and payment software that gives your customers and clients the most value. Corvee Tax Planning software for accountants automatically scans and identifies the most critical details from tax returns to help you save time. If you add in questions and tax returns, you’ll have 99 percent of the information needed to develop an efficient tax plan that will make your clients more money every year. When you use Corvee Tax Planning software, it’s possible to complete all of this within minutes. Corvee Client Collaboration provides you with the option to send and electronically sign engagement letters, customized templates from the internet, questionnaires, and passwords, and files securely. You can set reminders for SMS and email to aid in back-and-forth client communication within their software designed for accounting firms. Send your client a secure message with specific demands to make sure they understand what’s expected from them. Then, notify them after you’ve approved their file.

Conclusion

Your business is a living, breathing entity. It needs constant nurturing and care to thrive. Tax time can be one of the most contentious periods of the year for small business owners. We’ve put together this article to make your tax planning software experience as easy as possible. Tax planning software can help small- and medium-sized businesses manage their tax obligations while minimizing tax liability. With the right tax software, you can file documents in one place and keep records organized year-round with just a few simple clicks. You may also be interested in Sales Tax Calculators or best expense trackers. 7 sales tax compliance software for ecommerce business.

![]()